As domestic manufacturing makes a roaring comeback in the improving economy, it is vital that manufacturers have the financial wherewithal at their disposal to meet their clients' demands. If you lack the money, credit and liquid assets to keep your manufacturing business afloat, or if you have slow-paying clients, you could potentially face fiscal challenges that could undermine your productivity and your business' future.

Rather than pinning your hopes on a bank loan that could fall through or having to sell off some of your most valuable business assets while you wait for your customers to pay their invoices, you can instead get the money you need today through factoring. When you factor your accounts receivables, you can overcome issues that could ultimately sink your manufacturing business.

1) Making Payroll and Affording Operational Expenses

Slow-paying clients combined with your own inability to secure a bank loan can lead to difficulties in making payroll and covering your business' day-to-day operational expenses. You simply lack the cash flow to meet these important financial obligations that you ultimately cannot avoid having to deal with on time.

When you factor your invoices, however, you can get the cash to meet these obligations in a few days' time without having to wait for a bank to approve you for a loan or fear that your credit will ruin your chances for outside financing. The factor that buys your invoices will free you from worrying about when your clients will pay their outstanding balances, letting you focus on keeping your business functioning as it should each day.

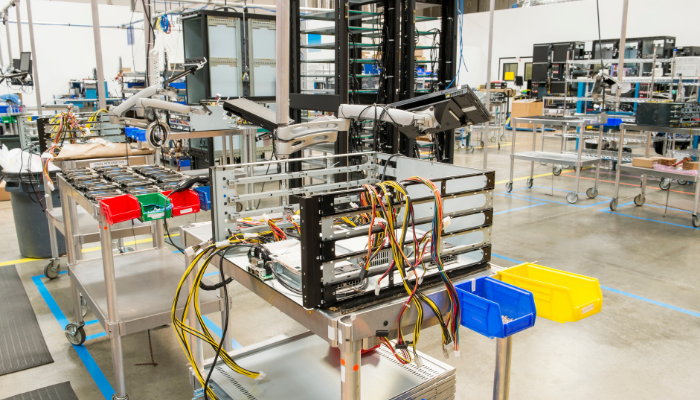

2) Updating and Upgrading Equipment

Being competitive in today's manufacturing industry requires that you have updated equipment in your business. You can determine that your equipment needs improving if:

- Your return rate is increasing

- Your business' defect rate is on the rise

- You are losing sales

- Your repair expenses are becoming too costly

- You cannot find the parts you need to keep your outdated equipment running

Without a doubt, upgrading and investing in new equipment can be an expensive, yet necessary undertaking. Rather than wait until your outstanding invoices to be paid or take your chances on a bank loan that may not be approved in time, you can get the money you need today with factoring.

3) Expanding Your Client Base and Market Reach

If expanding your business is one of your top priorities, you will need the cash flow to back up this desire. It costs money to attract new clients and take your business outside of your current market, something that may not be possible if you have to wait on late invoice payments or a bank to approve a loan for you.

If you want to start this process as quickly as possible, you could get the results you want by selling your invoices to a factor. The money that you can get within a day or two can be put to immediate use, letting you recoup your expenses faster and have a thriving business at your disposal in the future.

4) Buying Supplies and Materials

Insufficient access to supplies and materials has historically always been a primary reason why many manufacturing businesses fail. You simply must be able to get the supplies and materials you need at the precise moment when your production calls for them, if not well before.

You cannot afford to bank your ability to buy these necessities on outstanding invoices or your own credit, particularly if your score is low or you do not have the money to back up a loan. Because you could quickly lose your company if you do not have the materials on hand for production, you can remain productive, viable and profitable by using factoring for this important purpose. Factoring allows you to purchase:

- Raw materials

- Office supplies

- Software and computer programs

- Secondary materials like boxes or cellophane to prepare your products for shipping

Running out of even the most seemingly insignificant supply can bring your productivity to a halt. Factoring helps you ensure that you have what you need on hand at all times.

A healthy cash flow is vital to your manufacturing business. If you have slow-paying invoice clients and lack the credit and assets for a bank loan, you can keep your company growing and thriving by utilizing factoring for your financial needs.