The success of your business depends significantly on the quality of your equipment. You may be unable to serve your customers, provide a service or product, or take care of a range of other everyday obligations when your equipment is outdated and broken or you lack the necessary supplies entirely. When you need to buy things like computers, furniture, printers and other machinery for your company, you may wonder what you should do to get the supplies you need without compromising your viability. You can decide between leasing or buying your equipment by knowing these key facts about both finance options.

The Advantages of Leasing

No Down Payment or Good Credit Required

Much of your decision may be based on how much money you actually have to put toward acquiring your equipment. If you have just started your business, have poor credit, or just lack enough money to buy your supplies outright, you can still get what you need when you lease these necessities. You can get what you need without having to put down a large down payment, go through a credit check or take out a new line of credit when you opt for leasing your equipment.

Maintenance Costs Included

Another advantage that comes with leasing involves the maintenance and repairs of your equipment. Many leasing companies include the cost of these services in your monthly payments. If a piece of machinery breaks or needs to be repaired, you typically can call the company, which will then dispatch a repairman to your business free of charge. Maintenance and repair fees can be expensive, which is why many business people prefer to lease their equipment.

The Disadvantages of Leasing

Bigger Price for Equipment

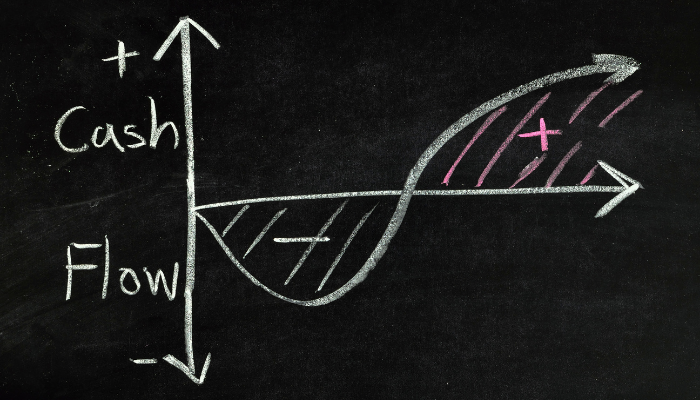

As advantageous as it may be to lease what you need for your business, this option can also work to your disadvantage if you ideally are looking to save money on the overall price. In fact, leasing typically inflates the price you will end up paying for your equipment if you decide to buy it at the end of your contract. As you look back at the payments you have made over time, you could end up paying way more than the equipment is actually worth.

Restrictions on Use

Along with paying a bigger end price, you also may be limited on what you can actually use the equipment for in your business. You generally cannot alter its appearance or function without first asking the permission of the leasing company. You also cannot use it as collateral on a loan or take out an equity loan on it because it does not belong to you outright.

The Benefits of Buying

Outright Ownership

When you prefer to own your business equipment without having to answer to someone else about its use, you may consider buying it outright. This option gives you total control over your business' supplies. You can alter its appearance, function and location without penalty. Your name will appear on the titles or registrations for these items rather than that of a leasing company.

Selling It or Using It as Collateral

When you buy your furniture and machinery, you can also use it as collateral on a loan or take out a loan against it as you see fit. If you need a short term loan from a bank, for example, you can put up your office furniture as collateral until the loan is paid in full.

You can also sell your equipment without having to pay off a lease or asking anyone's permission. If you no longer need it or you want to sell some belongings to raise some cash, you have that option, which otherwise would not be available to you if you were leasing these things.

The Disadvantages of Buying

Bigger down Payment or Initial Investment

Of course, when you buy what you need for your business you will typically pay more out-of-pocket than if you were to lease these items. You could put out hundreds or thousands of dollars to buy your equipment, which may jeopardize your operational budget if you lack the cushion in your business' bank account. You may need to save up money over a course of a few weeks or months before you can afford to buy what you need to stay profitable and functional.

Responsibility for Maintenance and Repairs

When you buy your equipment, you will be solely responsible for keeping it in good repair. You cannot escape the costs associated with repairs and maintenance as you would when you lease these items. Paying for these services can be expensive and also make your monthly budget less predictable. You may need to set aside money each month for this purpose.

As a business owner, you have several options to help you get the equipment you need to stay profitable and operational. You can decide between leasing and buying by knowing these facts about both choices.