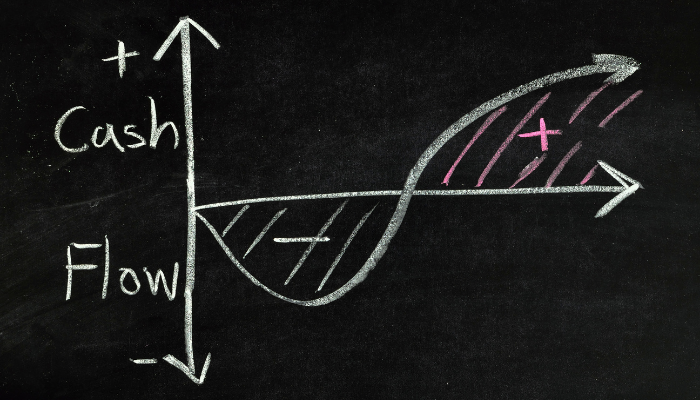

Are you in the commercial transportation business? Are you facing a sudden cash flow shortage due to an unexpected expense or a temporary slowdown in revenue? If so, transportation factoring may be the solution to your problem. Transportation factoring offers cash flow benefits for many transport and trucking companies as long as they meet the conditions to qualify for approval.

How Transportation Factoring Works

Transportation factoring works like other invoice factoring arrangements. The business owner approaches the factor and requests approval. After the factor examines the records of the business's customers to check their payment histories and credit records, the company may decide to grant the request by issuing a lump-sum payment for most of the invoice value. Once the lump-sum payment has been remitted, the factoring company sets out to collect the outstanding payments from the business's customers. After the customers pay off their current invoices, the factor subtracts its fee and then sends the balance to the business.

How Transportation Factoring Can Benefit Your Company

Depending on your specific needs, transportation factoring can offer several advantages for your business. Getting the funding will help you to cover your necessary expenses. Unlike some funding sources, the factoring company will not put restrictions on how you can use your capital. You can use your increased cash flow for any business expense you're facing including payroll or repair bills. Transport companies often deal with increased fuel and oil costs which a factoring advance can help cover.

Another benefit of transportation factoring is the speed of which the process is resolved. Some companies have been able to get their funds in as little as 48 hours after processing. This is extremely convenient if you're dealing with a sudden expense. Factoring is also flexible because the amount you can have advanced varies with your outstanding invoices for that month. If you need additional capital you can simply factor more invoices during that period.

When you take advantage of transportation factoring, you also relinquish the responsibility of collecting on the invoices yourself. This means that you won't have to keep up with the customer records, make collection calls or send out reminder notices for payment. The factoring company will do all of that work for you.

In short, businesses that use transportation factoring qualify for several advantages. This arrangement offers several cash flow benefits for transportation companies of all sizes including quick access to cash and increased spending flexibility.