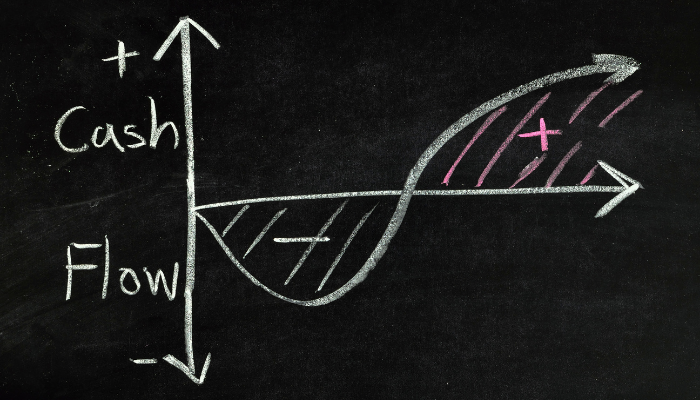

If you're a small company owner, you might be used to running your business on very tight profit margins. Most small and new businesses struggle with cash flow for some time before finally finding their footing a year or two later. However, if you run into cash problems and you have a sudden, unexpected expense it can literally cause your company to collapse. This is where accounts receivable factoring can really boost your bottom line. With this cash advance option you can get the funds you need to carry your business while you're waiting for your customers to pay their invoices.

About Accounts Receivable Factoring

Accounts receivable factoring is an arrangement that allows you to sell the value of your outstanding invoices to a third-party who then advances you the bulk of the invoice value in cash. Typically, factoring companies can issue the funds within seven days and sometimes in as little as two days. Once the factoring firm sends you the funds, their staff assumes responsibility for collecting on the invoices from your customer. After the customer pays off the invoice the invoice factoring company sends you the remainder of the funds minus their standard fee.

Who Can Benefit from Accounts Receivable Factoring?

While many companies can benefit from using accounts receivable factoring, there are two types of businesses in particular that can get assistance from factoring. A business that's only been open for a short time may start off with very little cash reserves and may find it very difficult to secure financing from a traditional lending institution. A company that has less than perfect credit can also benefit from factoring for similar reasons.

Advantages of Factoring vs. a Bank Loan

Factoring has many advantages over a bank loan. For one thing, businesses don't need good credit to qualify for factoring. Getting a factoring request approved depends largely on the creditworthiness of the customer who receives the invoice. Another advantage of factoring is that it doesn't require you to take on additional debt. Taking on more debt can put your business at risk if you run into cash problems later. With factoring you won't have to take that risk.

Accounts receivable factoring offers a quick and easy way for companies to increase their cash flow. After learning about the benefits of this arrangement, you might decide that accounts receivable factoring is a good fit for your business.