The terms agreed upon between the business and new customers need to be established beforehand to avoid any confusion or misrepresentation, but how can there be a negotiation between the two that is open and doesn't lead to more frustration? Figuring out payment terms between the business and customer starts with an open line of communication and knowing how to masterfully negotiate.

Below are some tips on proper terms with new customers that any small and medium sized business should take into account for faster, on time payments.

Timing Is Key and Needs to Be Monitored

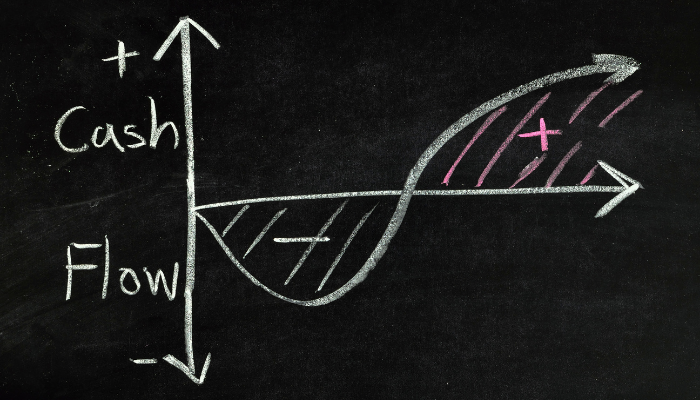

When it comes to invoicing, there needs to be a clear indicator of when payment is due. Payment dates keep a business organized and make cash flow easier to estimate as well. There are a couple of different ways to ensure that timing remains key with business invoices, including:

When it comes to invoicing, there needs to be a clear indicator of when payment is due. Payment dates keep a business organized and make cash flow easier to estimate as well. There are a couple of different ways to ensure that timing remains key with business invoices, including:

- The shorter payments are going to be best for a small business. This is true even if this means negotiating a down payment of sorts or progress payments on certain dates.

- As soon as the new customer has become a client, an invoice needs to be drafted immediately to keep things moving smoothly.

Not knowing when invoices are coming in and what money is due to the company will only result in a bad relationship between the customer and business. Invoicing is crucial and needs to be done as professionally as possible. A factoring company can help with receivables and ensuring steady cash flow.

Discounts and Penalties Can Help with Cash Flow

Looking to increase your cash flow? By making clear terms on both discounts and penalties with new customers, this can increase cash flow. Customers with discounts will be more willing to bring on their family and friends and penalties will be set in place as a type of safety net for customers who might not pay on time or not at all after an invoice has been sent.

Having this extra line of cash flow can be a life saver for a small business during tight months or in-between payment periods that might be extended out longer. Also, providing discounts to new customers means they are more likely to stay on as on-going, loyal customers.

However, that doesn't mean that a business needs to bend over backwards for a new customer. Business owners still need to negotiate firmly when it comes to discounts and making the language as clear as possible with new customer contracts. The same goes with any possible penalties put in place. This will protect the business as well as having the added benefit of extra cash flow.

Negotiating terms with a new customer can be simple enough when the groundwork is already there and businesses remain firm on what they expect from the customer.

*Image courtesy of freedigitalphotos.net