If you've already looked into using traditional assets like equipment or receivables to secure financing (and if not, start here), you might be surprised at how many other tools are sitting quietly on your balance sheet, just waiting to be put to work.

Today’s ABL market isn’t just growing, it’s booming. Global forecasts expect the space to hit $1.43 trillion by 2029, with a healthy 12.5% CAGR. And it’s not just banks getting creative; non-traditional lenders are topping up the field, recognizing the value of assets such as licensing income, prepaid contracts, or even completed project phases as real collateral. That means more ways to access working capital without giving up equity or waiting for a traditional lender to say, “Yes.”

Here’s the good news: If you’re already doing great work and building something valuable, you may already have what lenders are looking for. Let’s walk through the lesser-known assets that could help unlock the next phase of your business growth.

Recurring Revenue from Digital Licensing & SaaS Subscriptions

Here's where SaaS can do more than pay the bills; it can help unlock capital. A lender sees steady, contract-backed subscriptions as a sign that your revenue isn't just hopeful, it's predictable.

Do you bring in steady revenue from subscriptions or digital licensing? That income isn’t just reliable, it’s leverageable. Lenders are increasingly warming up to recurring revenue, especially if it’s backed by long-term contracts and loyal customers.

Why it works: Subscription income is predictable, contract-backed, and often automated, making it appealing to lenders who prefer stable, recurring inflows over one-time project work.

What lenders want:

- Signed agreements

- Payment history and renewal rates

- Clear churn metrics

Best for:

- Tech firms

- Digital media

- Online education platforms

- SaaS businesses that thrive on consistent subscriber revenue

Service Agreements & Maintenance Contracts

Too many businesses overlook the power of their service agreements. But if you’ve got clients coming back year after year, that’s not just loyalty, it’s leverage.

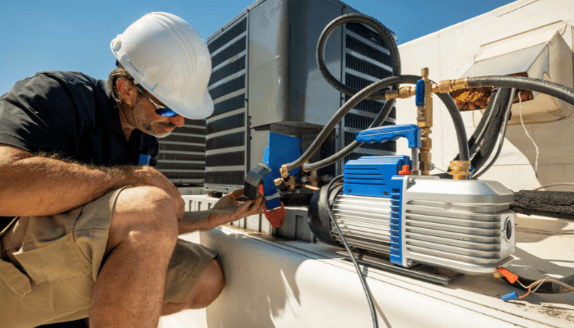

If your business runs on long-term service contracts, think HVAC, IT support, or facility maintenance, you’ve got more than reliable work. You’ve got a financial asset.

Lenders see multi-month or multi-year agreements as signs of stable, repeatable income. And when those contracts come with a strong track record of on-time payments and consistent delivery? Even better.

Why it works: Long-term service contracts signal ongoing customer demand and operational stability. When paired with good documentation, they show lenders a reliable stream of repeat income.

What lenders want:

- Reliable payment history

- Clear, professional contract terms

- Proof that you consistently deliver on what you promise

Best for:

- Service-based businesses with loyal clients and predictable workloads

- Especially in commercial maintenance, IT, logistics, and support industries

Franchise Royalties

Yes, if you have a reliable stream of franchise royalty payments backed by contracts, it can serve as a compelling form of collateral. Lenders see this as predictable, enforceable income.

If you collect royalties from franchisees, monthly, quarterly, or otherwise, you’re not just building brand reach; you’re creating a stream of dependable income that lenders may be willing to finance against.

Why it works: Franchise agreements are enforceable and based on sales. With a diversified group of franchisees and consistent royalty payments, you’ve got recurring revenue that’s both predictable and documented.

What lenders want:

- Signed franchise agreements

- Documented royalty payment schedules

- Consistent track record of on-time payments

When your royalties are supported by strong contracts and a track record of payments, lenders see an opportunity to offer funding without asking you to give up ownership.

Best for:

- Franchisors with multiple locations

- History of steady royalty income across retail, service, or food-based operations.

Patented IP & Trademark Portfolios

You don’t need to be a Fortune 500 company to own valuable intellectual property. If your business holds patents or trademarks, especially ones tied to sales or licensing, you might be sitting on serious untapped lending power.

Why it works: Patents and trademarks often reflect your most innovative work and brand strength. When they’re actively generating income or licensing revenue, lenders treat them as viable collateral.

Let’s say your patented product line consistently drives revenue or your trademark is well-known in a niche market. You may be able to use that IP to support an asset-based loan, giving you growth capital without giving up control or equity.

What lenders look for:

- Proof of ownership

- Active use and enforceability

- Licensing agreements and monetization history

Best for:

- Businesses with unique products

- Strong brand recognition

- Active licensing agreements, especially in manufacturing, e-commerce, or health tech sectors

Got patents or trademarks sitting idle? It might be time to dust them off, organize your portfolio, and unlock new financing options you didn’t know you had.

Contracted Utility Credits or Rebates

Can rebates or energy credits be used in financing?

They can, if they’re documented. Signed rebate agreements or utility credit schedules tied to recent upgrades may qualify as future income lenders are willing to advance against.

Did your business go green recently? That upgrade could be more than just good for the environment; it might help you secure funding.

Energy-efficient improvements like solar installs or LED retrofits often come with rebates or utility credits. When those payouts are backed by signed agreements, lenders may view them as a predictable future income stream.

Why it works: Utility rebates and energy credits, when backed by formal agreements, represent guaranteed incoming funds. For lenders, this makes them a short-term, low-risk asset, especially if tied to a completed and verifiable project.

What lenders want:

- Signed or scheduled rebate agreements

- Proof of completion for the qualifying project

Best for:

- Construction firms

- Clean energy contractors

- Property managers

- Commercial developers investing in sustainability upgrades

Prepaid Expenses

Think of prepaid expenses as a hidden strength in your books. Lenders know that if your insurance or rent is already paid, your future cash flow is that much more protected.

Prepaid doesn’t mean forgotten. If you’ve already paid for things like insurance, rent, or vendor retainers up front, you’ve reduced your near-term obligations, and lenders take that into account.

These prepaid expenses might not count as primary collateral, but they can still strengthen your loan application. Why? Because they show financial foresight and lower the risk of unexpected costs derailing your operations.

Why it works: Prepaid expenses reduce upcoming liabilities, helping your cash flow stay stable. That’s a green flag to lenders assessing your risk and repayment ability.

What lenders want:

- Receipts, invoices, or statements that prove the prepayment

- Clear timelines for coverage or service

- How this investment benefits ongoing operations

Best for:

- Businesses that prepay annual expenses to manage cash flow or lock in pricing

- Especially in insurance-heavy or lease-driven industries

Completed Work in Progress (WIP)

Can completed work count as collateral?

Absolutely. Finished work that hasn’t been invoiced yet still holds value, especially in project-driven businesses. If you can show the job is done and documented, lenders may include it in your borrowing base.

This is especially useful for businesses where a large portion of the value happens before the invoice ever goes out.

Why it works: Documented, completed work, even if not yet invoiced, can be seen as near-term revenue. For lenders, that’s value they can lend against with confidence.

What lenders want:

- Signed contracts

- Progress logs or approval docs

- Detailed breakdowns of labor, materials, and costs

Best for:

- Contractors

- Consultants

- Design firms

- Service-based businesses working on multi-phase or milestone driven projects

Why These Assets Matter Now

Asset-based lending isn’t just about buildings, trucks, or warehouse inventory anymore. Lenders are finally catching up to how modern businesses actually run, digitally, flexibly, and often without piles of physical assets.

Whether you’re building a subscriber base, running a service team, or holding valuable IP, the assets you already rely on to generate revenue might just open doors to new capital.

Here’s what matters:

- Creative collateral expands your options. The more variety in your asset mix, the more ways you have to qualify.

- Clean documentation builds confidence. Lenders want clear contracts, billing records, and performance reports.

- Consistency counts. Recurring revenue, renewals, and strong delivery history go a long way toward getting a “yes.”

Before You Move Forward

A few final reminders before you take the next step:

- Know your advance rates: Not all assets are treated equally. Receivables might get you 70–90%, while IP or rebates may be closer to 30–50%.

- Stay organized: The more buttoned-up your contracts, invoices, and logs are, the smoother your approval process will be.

- Plan for the unexpected: Every income stream has its ups and downs. Be ready with buffers and backup plans.

What’s Next?

Even if you’re not actively seeking financing, taking stock of these lesser-known assets can give you a better picture of your business’s real strength. From recurring revenue to prepaid expenses, each of these items tells a story about how stable, prepared, and growth-ready you are.

Understanding their value, on paper and in practice, can help you make more informed decisions, whether you're exploring funding now or laying the groundwork for future opportunities.