What is Equipment Financing?

Put simply, equipment financing is a loan you take out to purchase a piece of equipment for your company. The lender uses the value of the asset as the basis for the loan and you pay back the loan over time using your business sales or receipts. You'll need to have satisfactory credit and you may also have to pay a down payment to qualify for the finance plan.

Choosing Appropriate Equipment to Finance

The most important part of getting equipment financing is finding out what type of equipment you should finance. If you use the loan to purchase an asset that loses value quickly such as a computer or another type of small electronic equipment you'll likely end up continuing to pay off the loan long after the useful life of the item has expired. This is why it's wise to use equipment financing on long-term assets such as large equipment or vehicles. Generally, these assets retain much of their value after the loan has been paid off which means you'll have plenty of time to recoup your loan payments in the course of your business.

Advantages and Disadvantages of Equipment Financing

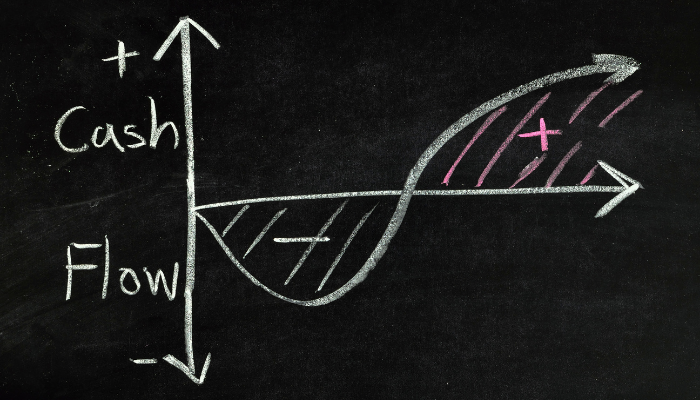

Like all finance plans there are both advantages and disadvantages to equipment financing. The advantages include the ready access to cash so that you don't have to wait to make the necessary purchases to expand or maintain your business. If you select a long-term asset that holds its value for some time your company's profit margins will rise substantially once you pay off the loan. You'll also get to use certain tax deductions for loan costs and depreciation of the asset's value over time.

The disadvantages of equipment financing, though, include high loan payments particularly in the early years of the loan. Like many loans equipment financing payments are mostly interest in the beginning which means you'll make the highest payments in the first year or so. These payments may make it difficult for some businesses to qualify for a loan.

Equipment finance plans can help company owners afford long-term office equipment that they need for their businesses. If you weigh the advantages and disadvantages of equipment financing you'll be able to choose a good plan for your company.